north dakota sales tax refund

North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North Carolinas. The dataset also includes useful demographic information about each jurisdiction including location.

See The New State Seal Specialty Emblem Here South Dakota Department Of Revenue

Qualifying purchases include goods purchased to be removed from North Dakota for use exclusively outside the state taxable purchases are 2500 or more per receipt and the refund request is 1500 or more.

. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Our dataset includes sales tax rates for all local sales tax jurisdictions at state county city and district levels broken down by 5-digit ZIP code. Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets.

Autonomous Systems Technology AST. The INDIANA legislature has entered a special session to discuss a sales tax cap on gasoline a sales tax suspension on residential utility bills and a 225 tax refund. The use of ground-based autonomous technologies is expected to grow exponentially in the coming years and North Dakota is working hard to lead the nation in autonomy.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. State and federal tax refund intercepted. Writs of judicial and administrative execution.

While the Florida sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Maybe youre a natural sales person or have a knack for budgeting and finances. The sales tax is paid by the purchaser and collected by the seller.

North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Gretchen Whitmer signed the state budget but a tax cut package is still in flux as Democratic and Republican leadership have yet to come to a consensus.

North Dakota Legislative Branch. This page discusses various sales tax exemptions in Florida. Streamlined Sales and Use Tax Agreement.

North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Some exemptions include food and clothing. To obtain a refund on qualifying purchases the Canadian resident must complete the Canadian Residents Request for Sales Tax Refund Form.

North Dakota imposes a sales tax on retail sales. Why do I need a Sales Tax Certificate to purchase wholesale items for Resale in the State of Texas. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021.

As a wholesale company conducting business in the state of Texas you are required to have a sales tax certificate when purchasing items at wholesale prices Therefore suppliers must request a copy of your resale certificate before selling you items at wholesale. In Lieu of Sales Tax Fees Repealed 57-394. This part of the rules was repealed to that economic.

In Florida certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. In order for the CSE to be able to enforce child support orders you must do your job and cooperate in identifying the non-custodial parent establishing paternity and obtaining support orders. Taxable sales and purchases for January February and March of 2022 were 47 billion.

North Dakotas current remote sales tax rules went into effect in July 2019. North Dakota sales tax is comprised of 2 parts. Gross receipts tax is applied to sales of.

It includes sections on sales tax law as well as exemptions and refund information. Certain groceries any prosthetic or orthopedic. Prior to this the rule included the clause and 200 or more transactions.

Oil and Gas Gross Production Tax. Sales Tax Exemptions in Florida. Refund Motor Fuel Tax Repealed 57-51.

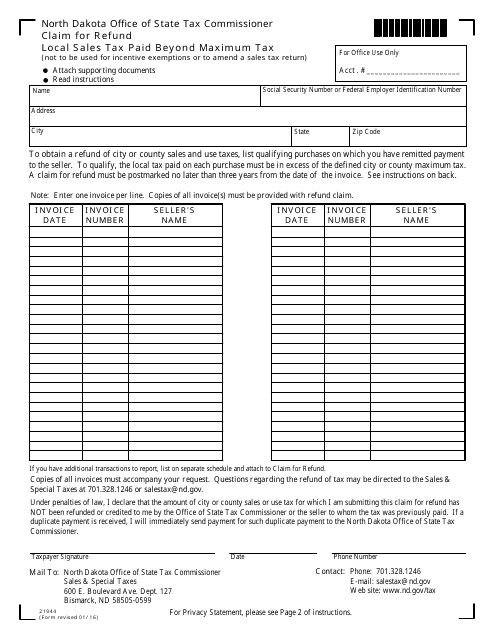

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

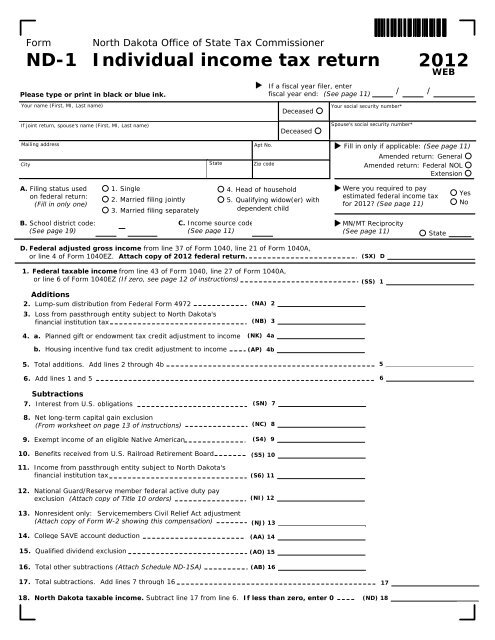

Form Nd 1 Individual Income Tax Return State Of North Dakota

Your Tax Refund Might Take Longer This Year

Ndtax Department Ndtaxdepartment Twitter

Nd Form St 2016 2022 Fill Out Tax Template Online Us Legal Forms

Where S My Refund Of North Dakota Taxes

North Dakota Tax Refund Canada Fill Online Printable Fillable Blank Pdffiller

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Nd State Tax Refund Tax Brackets Taxact

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

North Dakota Tax Forms And Instructions For 2021 Form Nd 1

2016 2022 Nd Form St Fill Online Printable Fillable Blank Pdffiller

File North Dakota Taxes Get A Fast Tax Refund E File Com

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller