st louis county personal property tax rate

Louis MO 63104 A branch of Roos County government is located at 41 South Central Ave Clayton MO 63105-2125. Place funds in for an inmate in the St.

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Personal Property Tax Waivers - St.

. We are committed to treating every property owner fairly and to providing clear accurate and timely information. Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

100 X 0x Total Tax Rate Estimated Tax Bill after deduction for taxes. Pay your personal property taxes online. Louis Irresistible 500 NW Plaza Dr St.

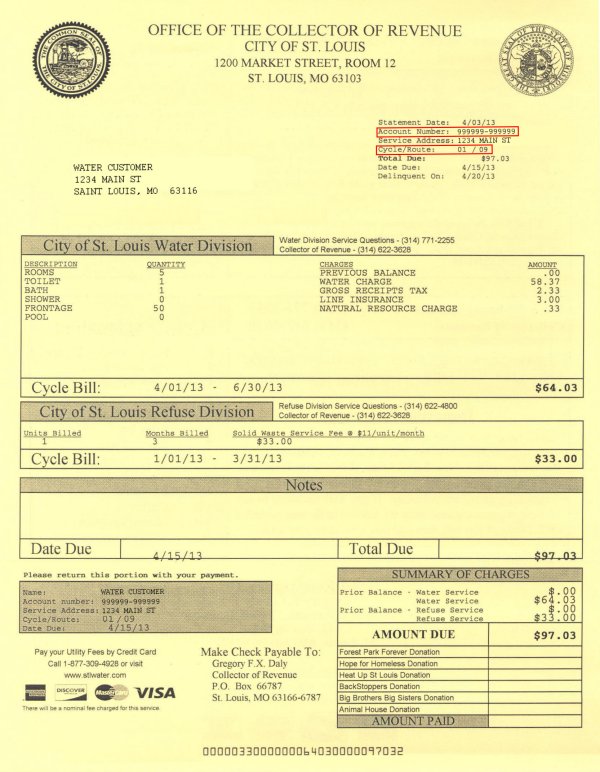

Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner. Louis personal property tax history print a tax receipt andor proceed to payment. Obtain a Personal Property Tax Receipt Instructions for how to find City of St.

The median property tax in St. Leave this field blank. How Do I Pay My St Louis County Personal Property Tax.

Residential Real Property Tax Rate. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year s. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. What is the personal property tax rate in St Louis county.

Calculating personal property taxes Formula Typical Typical Market Value Realizing X Assessment Rate 33 13 Estimated Typical Market Value Realizing X Tax Calculation Formula Estimated Market Value of the Property X Assessment Rate 33 13 Estimated Assessed Value. Address Collector of Revenue Office St. Louis County Commercial Real Estate has an additional commercial surcharge of 170 per 10000 Assessed Valuation.

How Do I Pay My St Louis County Personal Property Tax. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Louis City Hall Room 109 1200 Market Street St.

Additional methods of paying property taxes can be found at. How Are St Louis County Property Taxes Calculated. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes.

You moved to Missouri from out-of-state. May 15th - 1st Half Real Estate and Personal Property Taxes are due. The median property tax on a 17930000 house is 188265 in the United States.

Louis MO 63103-2895 Phone. Search by Account Number or Address. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

Your feedback was not sent. Pay your current or past real estate taxes online. All Personal Property Tax payments are due by December 31st of each year.

Its quick and easy. The exact property tax levied depends on the county in Missouri the property is located in. The median property tax on a 17930000 house is 224125 in St.

You can pay your current year and past years as well. Houses 5 days ago The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants. Mail payment and Property Tax Statement coupon to.

Collector of Revenue - St. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. This equation is used to determine the estimated market value of your property and the estimated assessed value.

Personal property is assessed at 33 and one-third percent one third of its value. Currently personal property taxes are based on 33 34 of its value statewide. To declare your personal property declare online by April 1st or download the printable forms.

03340 per 100 Assessed Valuation. Louis the personal property tax rate is about 828. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802 218 726-2380.

Charles County collects the highest property tax in Missouri levying an average of 237700 12 of median home value yearly in property taxes while Shannon County has the lowest property tax in the state collecting an average tax of 34800 0. 16 rows Personal Property Tax Rate. Taxes are imposed on.

The Crossings at Northwest 1000 NW Plaza Dr The county government building is located at 41 S Central Ave Clayton 63105 in Roos County. 03870 per 100 Assessed Valuation. November 15th - 2nd Half Agricultural Property Taxes are due.

Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. Locate print and download a copy of your marriage license. Asked about tax rates several Velda City officials said they werent aware they were higher than anywhere else.

This is your first vehicle. In the city of St. The median property tax on a 17930000 house is 163163 in Missouri.

Revenue St Louis County Website

Online Payments And Forms St Louis County Website

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Laminated Wall Map Office Products

Experience The Evolution We Promote Our Listings Everywhereitmatters You Get To Choose Video Real Estate Quotes Real Estate Sign Design Real Estate Buying

Your St Louis County Government St Louis County Website

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Revenue St Louis County Website

Print Tax Receipts St Louis County Website

Ownership Has Its Advantages Tax Payment Home Ownership Property Tax

Collector Of Revenue St Louis County Website

2022 Best St Louis Area Suburbs For Families Niche

Powered By Expert Realtors Creve Coeur Ladue Stl

County Assessor St Louis County Website

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis